| Affirm: Buy now, pay over time |

Developer: Affirm, Inc | Size: 230.9 MB |

Version: 3.210.3 | Updated: Dec 20, 2023 |

Rating: 4.8 | Category: Shopping |

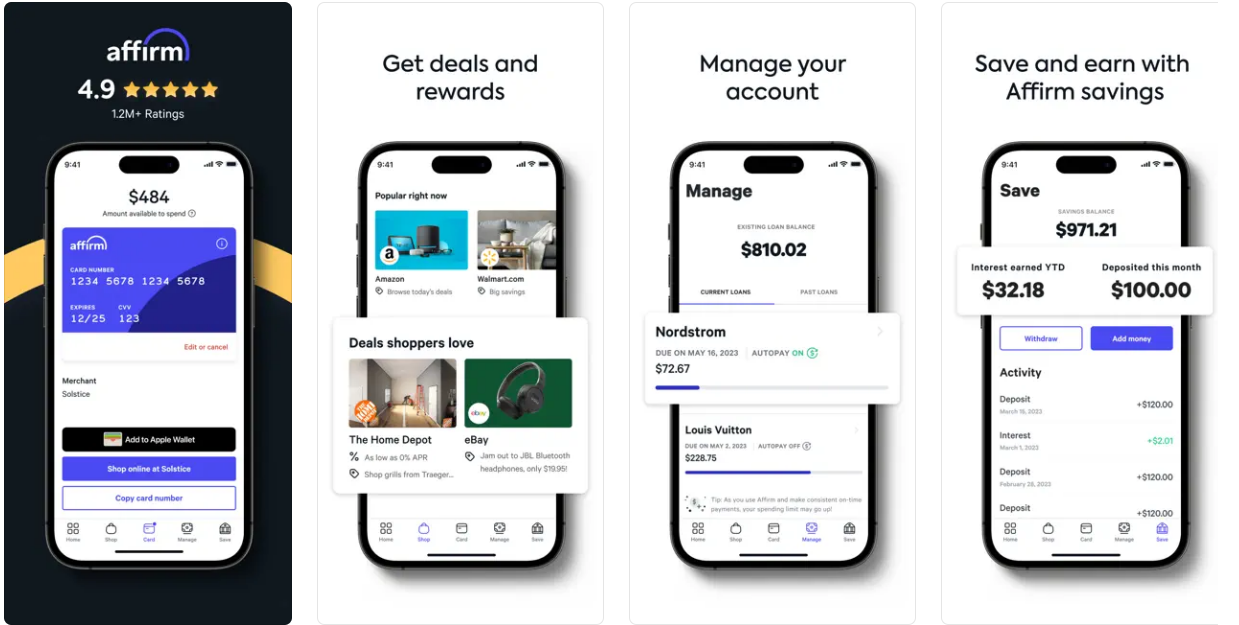

The Affirm App is a powerful financial tool that aims to simplify the process of financing purchases. With Affirm, users can easily split their payments into manageable installments, making it easier to afford expensive purchases without relying on credit cards or traditional loans. The app provides a seamless and transparent experience, allowing users to make informed decisions about their finances and budget more effectively. Whether you’re buying a new smartphone, furniture, or even booking a vacation, the Affirm App can help you spread out the payments and stay in control of your budget.

App Features & Benefits

- Easy Financing: The Affirm App offers a simple and straightforward financing solution. Users can select Affirm as a payment option at participating online and offline stores, and choose the payment plan that suits their needs. The app provides instant approval decisions, allowing users to complete their purchase without delay.

- Transparent Terms: One of the key benefits of using the Affirm App is its transparency. Users can see the exact monthly payment amount, interest rate, and repayment duration before making a purchase. There are no hidden fees or surprises, giving users peace of mind and helping them make informed financial decisions.

- Budgeting Tools: The app includes budgeting features that help users manage their finances effectively. Users can set spending limits, track their payment history, and receive reminders about upcoming payments. These tools empower users to stay on top of their financial obligations and avoid unnecessary debt.

- No Late Fees: Affirm understands that life can be unpredictable, and sometimes making payments on time becomes challenging. Unlike traditional credit cards, the app does not charge late fees. Instead, it offers flexible payment options and the ability to reschedule payments to accommodate unexpected circumstances.

- Prequalified Offers: The Affirm App allows users to check their eligibility for financing offers without impacting their credit score. By providing basic information, users can see personalized loan options and interest rates tailored to their financial profile. This feature helps users make informed purchase decisions and avoid unnecessary credit inquiries.

User Reviews of the App

- “The Affirm App has been a game-changer for me. I used to rely on credit cards for big purchases, but the option to split payments into smaller installments has made budgeting so much easier. The app is user-friendly, and the transparency in terms of interest rates and payment plans is refreshing. Highly recommended for anyone looking for a flexible financing solution.”

- “I love how transparent and straightforward the Affirm App is. It’s incredibly easy to use, and the budgeting tools have helped me stay on track with my payments. The ability to check prequalified offers without affecting my credit score is a huge plus. Affirm has made it possible for me to make larger purchases without the stress of immediate full payment.”

- “Affirm has been a lifesaver for me. I needed a new laptop for work, but I didn’t have the funds to pay upfront. The app allowed me to split the payment into manageable installments, and the interest rates were reasonable. It’s a fantastic alternative to traditional credit cards, and the customer service is top-notch.”

| Affirm: Buy now, pay over time |

3 Apps Similar to Affirm App

- Klarna: Klarna is a popular buy-now-pay-later app that offers flexible financing options for online and in-store purchases. It allows users to split payments into installments and provides transparent terms and conditions. Klarna also offers a smooth checkout experience and a variety of payment options.

- Afterpay: Afterpay is a similar app that allows users to divide their purchases into four interest-free payments. Users can shop at participating retailers, select Afterpay as the payment method, and make the initial payment at checkout. Afterpay offers automatic payment reminders and does not charge interest or fees if payments are made on time.

- PayPal Credit: PayPal Credit provides users with a line of credit that can be used for online purchases. It offers promotional financing options, allowing users to pay off their purchases over time with no interest if paid in full within a specified period. PayPal Credit integrates seamlessly with PayPal accounts and provides a convenient checkout experience.

Conclusion

The Affirm App is a powerful financial tool that empowers users to make purchases on their own terms. With its easy financing options, transparent terms, budgeting tools, no late fees policy, and prequalified offers, the app provides a flexible and user-friendly experience. User reviews highlight the app’s convenience, transparency, and effectiveness in managing finances. For users looking for similar apps, alternatives like Klarna, Afterpay, and PayPal Credit offer comparable features and financing solutions. Take control of your finances and make purchases with confidence using the Affirm App.